Evénements EpE pour la COP22

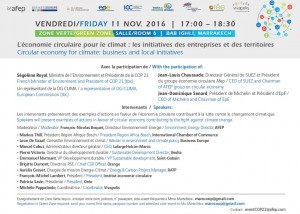

Friday 11 Nov. 2016 | 17:00 – 18:30

GREEN ZONE, SALLE/ROOM 6 | BAB IGHLI, MARRAKECH

Circular economy for climate: business and local initiatives

Saturday, November 12th 2016 – 11.30-13.00

Blue Zone – Observer room 2 (Pacific)

CLIMATE & TRADE

Can international trade help save the climate?

Saturday, November 12th 2016 – 3.00-3.45pm

Green Zone – Pavillon Comité21 / Club France

INTERNAL CARBON PRICING

A growing corporate practice

Wednesday, November 16th 2016 – 1.00-2.30pm

Green Zone – Room Morocco

DE-RISKING LOW-CARBON INVESTMENTS

The Paris Agreement represents an unprecedented commitment to tackle the climate challenge. Its success will, however, require supportive policies across many areas. Purposeful trade frameworks that support the transition to low-carbon consumption and production patterns will be key in this regard.

This side-event will explore key interactions between trade and the implementation of the Paris Agreement. The session will bring together experts, policymakers and industry representatives for an informed, open and constructive exchange of views.

The objective is to drive more coherent policy-making where the potential for trade to positively contribute to the climate action effort is realized, while ensuring that climate measures do not unnecessarily distort trade but rather promote an open economic system that contributes to sustainable, equitable and inclusive development.

Moderators

- Ingrid Jegou, Director, Climate, Energy and Natural Resources, ICTSD

- Claire Tutenuit, EpE, General Delegate

Speakers

- Pierre-André de Chalendar, Saint-Gobain, Chairman & CEO

- Peter Govindasamy, Director, International Trade Cluster, and Climate negotiator, Singapore

- Aik Hoe Lim, Director, Trade and Environment Division, WTO

- Steve Sawyer, Secretary-General of the Global Wind Energy Council (GWEC)

Harro Van Asselt, Professor of Climate Law and Policy, UEF Law School, Senior Research Fellow, Stockholm Environment Institute (SEI)

From words to action. While many companies in the world have called States to put a price on carbon, more and more implement an internal carbon price, as a one tool that companies can use to make progress towards a low-carbon society and turn the transition into an opportunity.

Internal carbon pricing is a practice that is still emerging. But the fast development of internal carbon pricing initiatives shows that companies share a vision in which carbon prices exist.

In doing so, they are sending a challenging message to governments and international institutions: companies are preparing for the transition to low-carbon economies, developing tools to support their transition and are putting themselves in a position whereby more ambitious climate policies are in their own interests.

Speakers

- Jean-Dominique Senard, CEO, Michelin & Chairman, EpE (q.a.)

- Nicolette Bartlett, Director Carbon Pricing, CDP

- Benoit Leguet, Managing Director, I4CE

- Emmanuel Normant, VP Sustainable Development, Saint-Gobain

- Claire Tutenuit, General Delegate, Entreprises pour l’Environnement

- Pierre Victoria, Sustainable Development Director, Veolia (tbc)

… and more to be confirmed

Effective mitigation of climate change requires investment flows to be redirected from high- to low-carbon technologies. But low-carbon investments often suffer from higher risks, especially in developing countries or when it comes to bring new technologies to market.

How to enable a massive low-carbon investment and sustainable growth for all? On the one hand, public resources may act as catalysts and cover risks that private actors are unable or unwilling to bear. On the other hand, the private sector can bring financial flows and innovation needed to make the necessary changeover. For this partnership to reach its full potential, investors need to be provided with the necessary signals, enabling environments, and incentives to confidently invest in emerging economies.

What are the economic and political signals that will reduce these risks? What measures should be implemented to make it more attractive to bet on less emitting technologies rather than on the more polluting?

Moderator

- Séverin Fischer, Head of environment and extra financial accountability, BNP Paribas

Speakers

- Jean-Patrick Masson, Vice-mayor, Ville de Dijon

- Antoine Rothey, Climate adviser, SNCF

- Mikir Shah, CEO of Africa Specialty Risk, Axa

- Claire Tutenuit, General Delegate, EpE

- Gilles Vermot-Desroches, Senior VP Sustainability, Schneider Electric (tbc)

… and more to be confirmed